What has happened?

Blackstone Minerals (ASX:BSX) released a brand new investor presentation to showcase not only their successes but also their future vision going forward and their journey of becoming a major supplier of Nickel to the booming EV battery industry. Although we highly recommend giving the presentation a full read (linked featured below), we covered some of the most interesting points below.

What are the Key Investment Highlights?

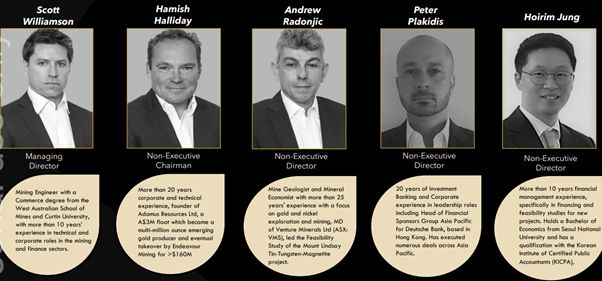

Experienced Board and Management Team

Blackstone features best in class leadership with a proven track record of corporate success and delivering value.

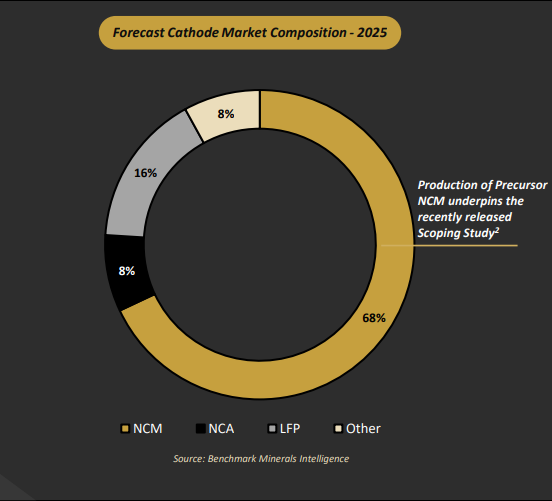

Strong Macro Tail Winds – Nickel Demand Drivers

Blackstone is taking steps to become a globally significant, green nickel™ product supplier catering to the battery market.

- Nickel rich cathodes are preferred as their chemistry enhances range, which has been long-term barrier to the adoption of EVs.

- Significant amounts of capital committed (existing, under construction and planned) into production of high nickel content cathodes.

- Security of supply concern is being addressed by direct investment into upstream and midstream markets. Chinese cathode manufacture GEM has doubled its stake to take control of the PT QMB New Energy Material Nickel/Cobalt Project in Indonesia; and LG signs MOU for $9.8bn investment deal into Indonesia which will involve fully integrated investment into mines upstream though to battery production.

- Demand for ethically, environmentally and responsibly sourced nickel will direct future investment flows and locations of future EV production hubs.

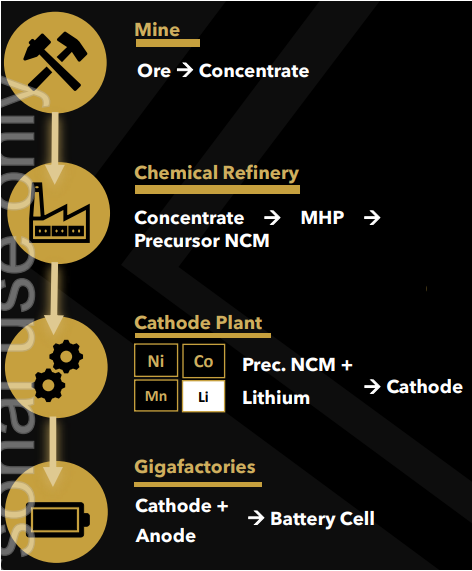

Unique Business Model – Integration of Li-ion Battery Supply Chains

Security of supply concern is driving investment further upstream into Li-ion battery supply chains.

- Blackstone’s flagship Ta Khoa Nickel – Copper – PGE Project in Vietnam is a district scale, green nickel™ sulphide opportunity.

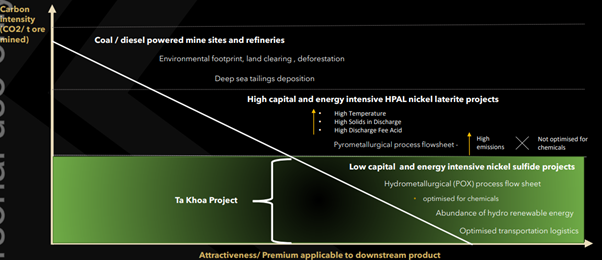

- Quantity and quality of global nickel sulphide resources are in decline.

- High proportion of future nickel supply for the EV industry will come from technically challenging and environmentally unfriendly nickel laterite projects.

Blackstone is forging partnerships to capture value across the Li-ion battery supply chain.

- Relationship with Trafigura increases and diversifies access to upstream nickel and cobalt materials.

- Partnership with EcoPro, South Korea’s largest cathode manufacturer, provides technical expertise into the downstream chemical industry.

Major players in the Li-ion battery industry are indicating rapidly increasing demand for downstream products.

- Blackstone is positioning to meet this demand through the staged construction of additional refining capacity.

- Blackstone continues to engage with multiple potential joint venture partners regarding offtake financing and or other funding options.

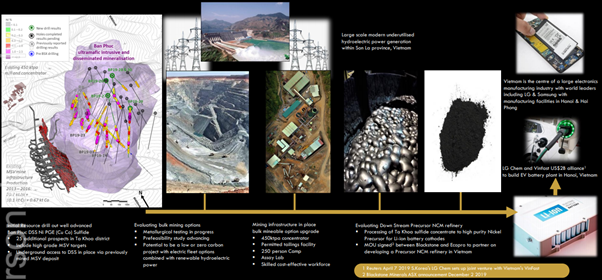

Large Scale, Infrastructure Advantage, Epicentre of Asia Electronics and EV Manufacturing

Unique Business Model – Project Location and Infrastructure

Scalable and Modular - Addressing Security of Supply Concerns

By combining the existing mineral inventory, exploration potential and ability to source third party concentrate, Blackstone can increase the scale of its downstream refining business to meet the rising demand for downstream nickel products.

Robust Base Case Scoping Study Economics

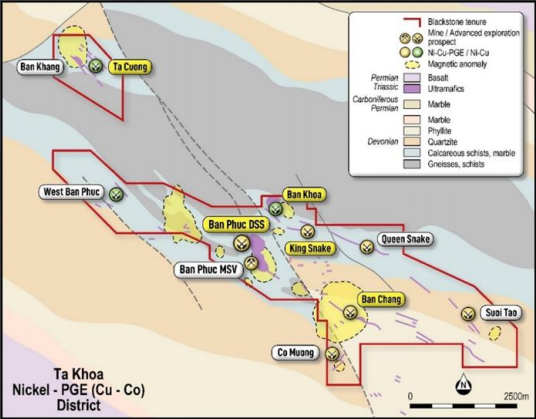

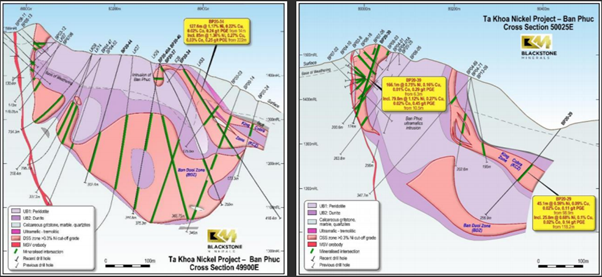

- The Company’s recently completed Scoping Study is underpinned by the large open pit DSS orebody at Ban Phuc, which includes a maiden Indicated Resource of 44.3Mt @ 0.52% Ni for 229Kt.

- The Scoping Study considers the construction of a new 4Mt concentrator, supplying up to 200kt of concentrate to a downstream chemical refinery.

Potential to add high grade MSV inventory and new DSS ore bodies

- Blackstone is actively exploring and currently has 10 active drill rigs.

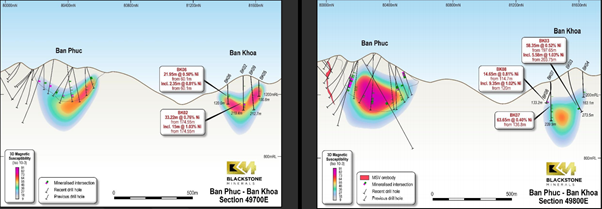

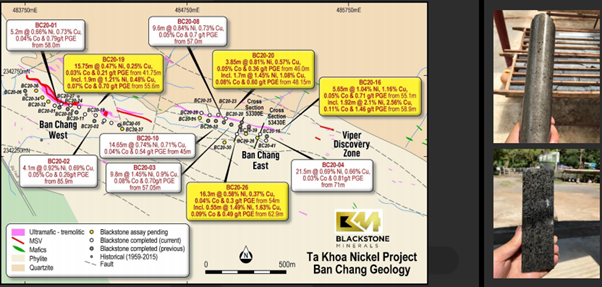

- High priority MSV targets include Ban Chang, King Snake and Ta Cuong, similar to the Ban Phuc MSV deposit mined by previous owners.

- By delineating multiple MSV resources, Blackstone will be able to defer upfront capital (for the 4Mt concentrator) and use the existing 450kt concentrator which has been built to international standards.

- Ban Khoa is the Company’s highest priority DSS target , with potential to add significant mine life.

Third party concentrate

- Relationship with Trafigura is a commitment to source upstream nickel and cobalt material through ethical and environmentally responsible supply chains.

- Third party concentrate is to be primarily sourced from Australia and Canada, with opportunities future potential alliances and partnerships to be formed.

Scalable and Modular - Potential for Multiple Joint-Venture Partners

Blackstone’s strategy to secure supply will lay the foundations to collaborate with multiple JV partners on the downstream business. Scalable chemical refinery business producing downstream Precursor Nickel:Cobalt:Manganese (NCM) products for the Lithium-ion battery industry. Blackstone’s downstream Precursor NCM product significantly improves the payability of nickel, from ~70-80% to ~125-135% of LME metal prices. The economics of Blackstone’s downstream business is driven by superior margins, with competitive advantages including a low-cost environment and access to renewable energy being key drivers of value.

Scalable and Modular

Blackstone Intends to Partner Collaboratively on the Downstream to Maximise Returns.

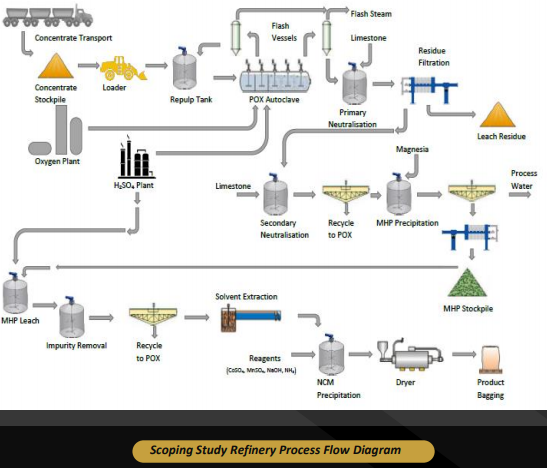

- Conversion of nickel concentrate into a MHP chemical, and thereafter to Precursor NCM uses established and well understood technology.

- Cheap hydro power renewable energy source is a key driver for compelling downstream economics (~US 7 cents per kwh).

- Vietnam is located within proximity to major battery market leaders. Blackstone will maximise product margin by reducing transport and rehandling costs.

- Major players such as LG Chem and Samsung SDI have already established supply chains in Vietnam. There is an ability for downstream products to be delivered directly to the battery supply chain.

Scalable and Modular - Scoping Study Represents Base Case Economics

Blackstone’s downstream Precursor NCM product significantly improves the payability of nickel, from ~70-80% to ~ 125-135% of LME metal prices.

Scoping Study represents base case production and economics:

- Annual Precursor NCM production of 25ktpa (~51% Ni content) from one 200ktpa autoclave.

- Gross Revenue of ~US$3.3 billion.

Security of supply solution enables the Scoping Study production profile to be scaled. Downstream PFS to contemplate the construction of four 200ktpa autoclaves:

- Significantly scaled nickel output and production of Precursor NCM.

- Ability to produce tailored products, enabling Blackstone to meet the specifications of a number of different customers.

Competitive Operating Advantage - Vietnam Business Landscape

Vietnam is a booming economy that is ideally placed to become a major hub supporting the Lithium-ion battery industry.

- Vietnam has minimized the impact of COVID-19 – economic recovery superior in South East Asia.

- Vietnam has unparalleled access to renewable energy infrastructure.

- Enviable track record of attracting foreign direct investment, particularly from other Asian countries.

- Strong business and work ethic - Vietnam has some of the lowest labour costs in the world coupled with high quality of output.

- Opportunity for OEMs and battery makers to diversify and decouple their supply chains from Indonesia and China.

- The cost of exploration in Vietnam is ~US$50/m – a fraction of the cost in Australia.

Investing In Blackstone is an Environmentally Responsible Allocation Of Capital

OEMs are demanding Li-ion batteries sourced from green nickel™ supply chains. The industry will be willing to pay a premium for responsibly sourced green nickel™.

District Scale Nickel Sulphide Opportunity – Ta Khoa Project

Aggressive Exploration Targeting High Grade MSV & DSS Mine Life Extensions

- District scale Nickel PGE (Cu Co) green nickel™ sulphide project.

- Prioritising targets within a 5km of existing Ban Phuc 450ktpa concentrator.

A number advanced stage MSV targets and a number of large bulk-tonnage DSS prospects:

- Ban Chang infill drilling for resource estimation is at an advance stage.

- Immediate success at King Snake being followed up aggressively, mineralisation open down dip and down plunge.

- Potential DSS mine life extensions are being investigated, Ban Khoa being the highest priority.

- In-house geophysics crew continue to identify highly prospective targets, currently at Suoi Tao and others.

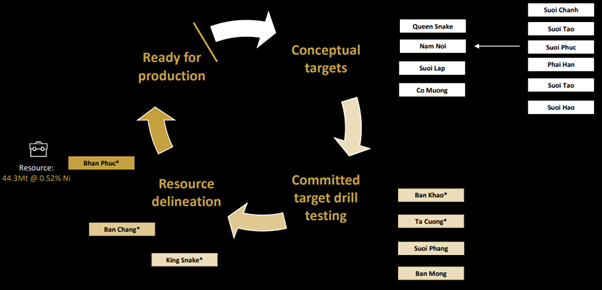

EXPLORATION PIPELINE

Ten active drill rigs targeting MSV and DSS prospects, intended to support the construction of a new 4Mtpa concentrator as well as the restart of the existing concentrator.

Ban Phuc DSS Underpins Base Case Economics

Ban Khoa has the Potential to add Significant Mine Life

District Scale Nickel Sulphide Opportunity – Ta Khoa Project – Staged Capex and By-Products

Staged Capex:

- Scoping Study considers immediate construction of 4Mtpa treatment facility to process ore mined at the large tonnage, Ban Phuc DSS orebody.

- Project also features an established and well-maintained 450ktpa concentrator and multiple high grade MSV prospects.

- Potential to defer construction and associated capex of the 4Mtpa plant by initially restarting the existing concentrator to treat high grade MSV ore.

- Doing so would improve the overall project NPV, as the initial capex requirement will be significantly reduced and may be funded through future cash flow.

By-Product Credits:

- By-product minerals (including copper, gold, platinum, palladium, and rhodium) that exist within the Ban Phuc DSS orebody can be recovered through flotation and processed within the downstream refinery.

- Additional processing infrastructure to allow the downstream processing to produce secondary saleable products to generate by-product credits is considered.

MAIDEN RESOURCE AT BAN CHANG EXPECTED IN 2021 H1

Drilling of new EM conductors at King Snake is intersecting massive Ni sulphides. Results indicate system is open down plunge and down dip.