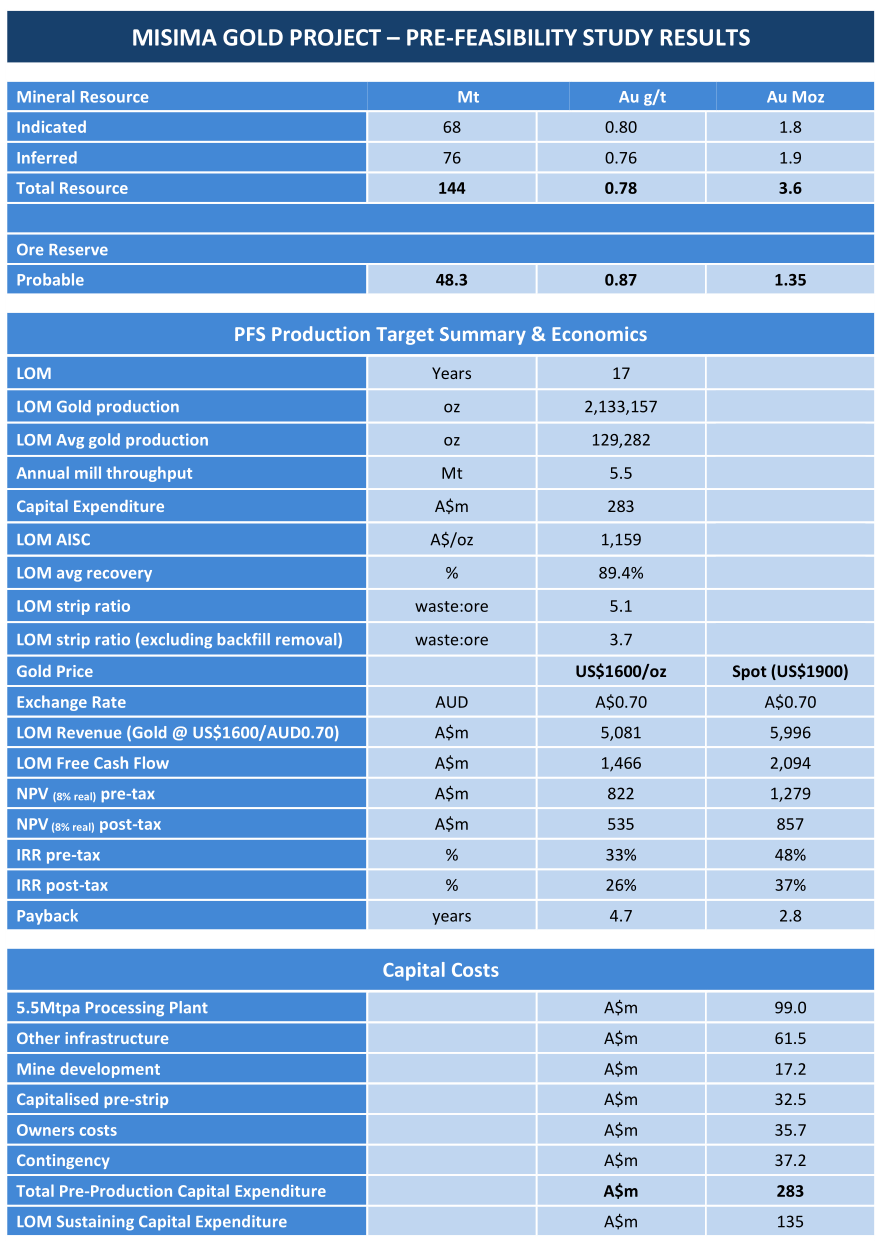

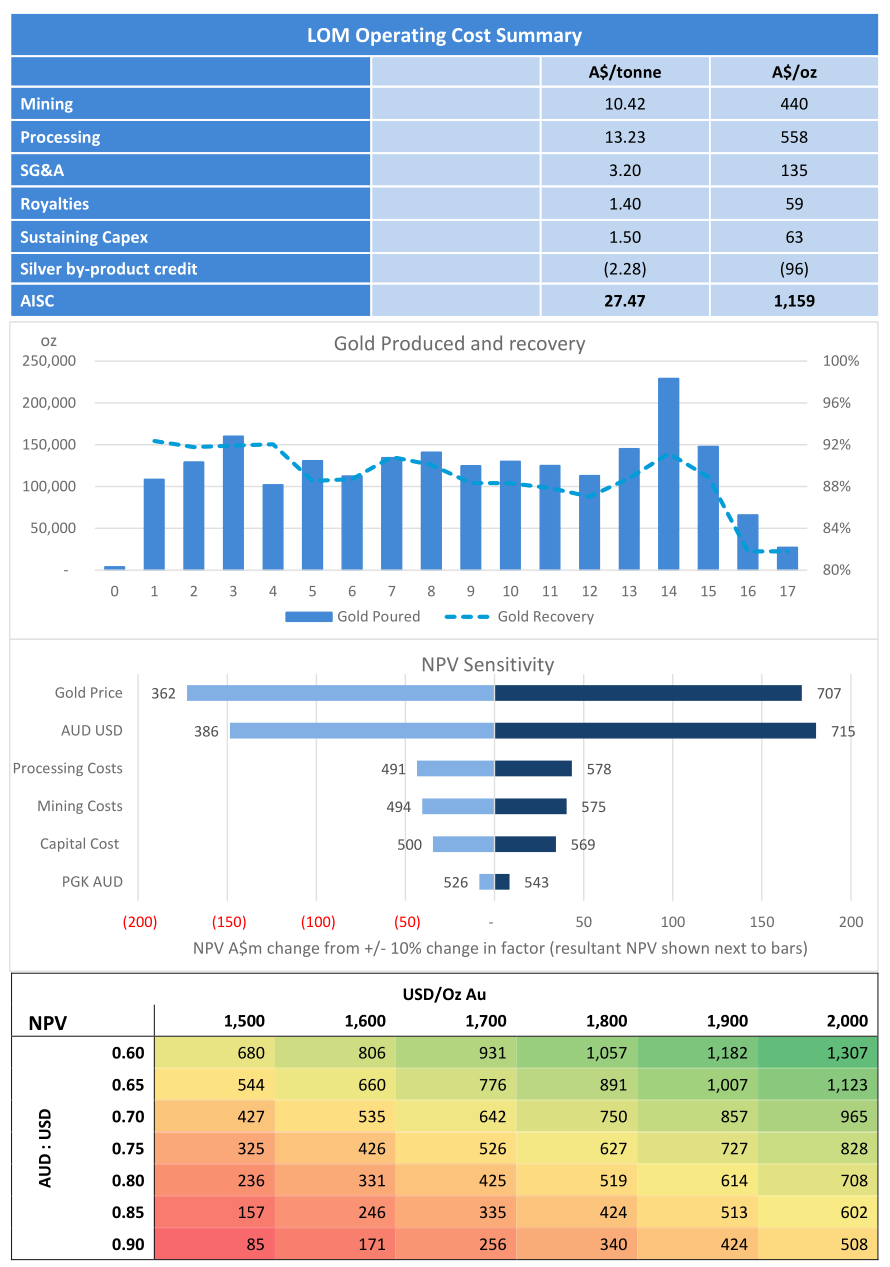

The PFS delivers forecast gold production of ~130kozpa at AISC A$1,159/oz with compelling project economics, long life, low capital intensity and outstanding growth potential.

A significant, long-life Asia-Pacific gold operation:

- 130,000ozpa average annual gold production over a 17-year mine life.

- 5.5Mtpa mining and processing operation on a brownfields site with extensive mining history.

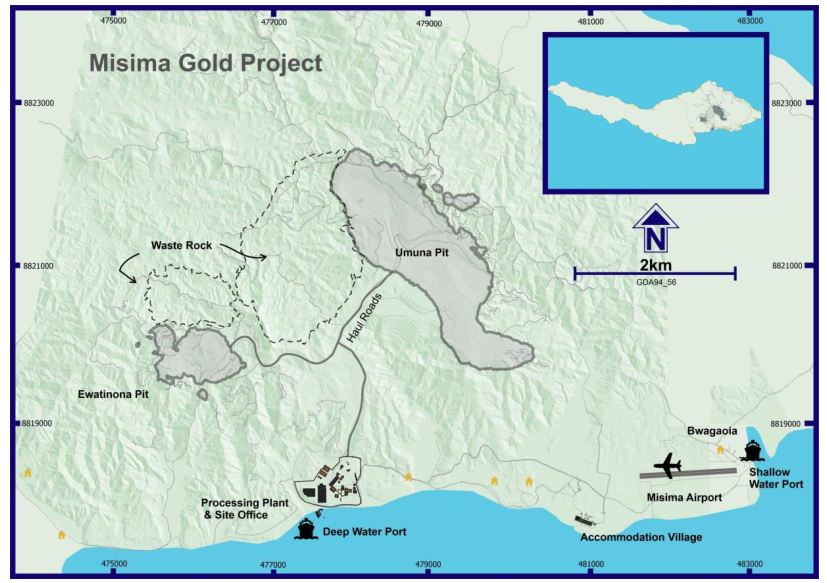

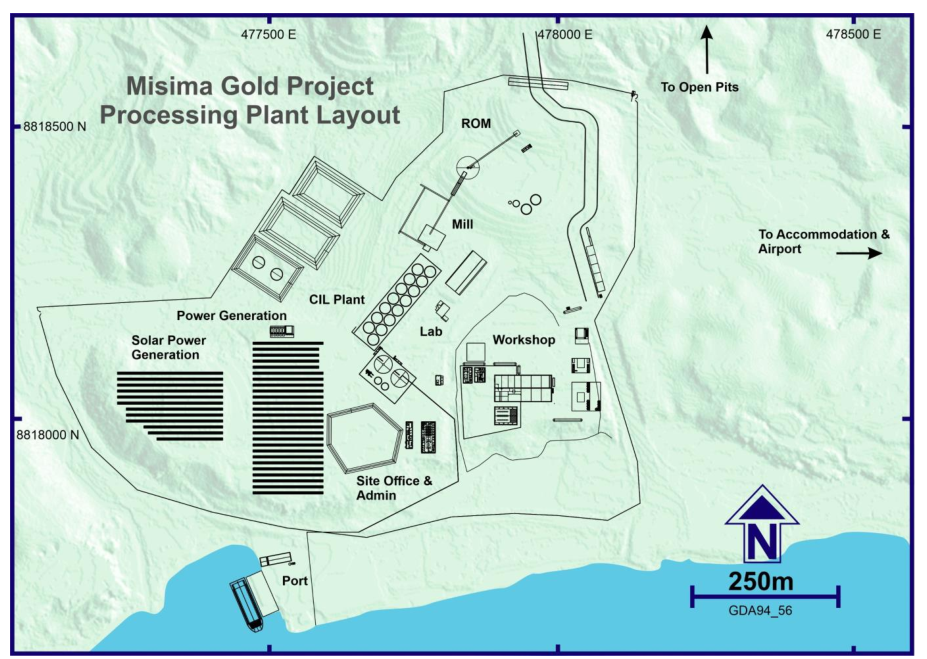

- Conventional CIL plant fed by the main Umuna Open Pit and Ewatinona Starter Pit.

- Low capital intensity with A$283m CAPEX including A$37m contingency.

Compelling project economics:

- Life-of-mine (LOM) average AISC of A$1,159/oz.

- LOM revenue of A$4.9 billion.

- LOM free cash-flow of A$1.5 billion.

- Pre-tax Net Present Value (NPV8%) of A$822m and 33% IRR at US$1,600/oz gold price.

- Pre-tax Net Present Value (NPV8%) of A$1.28b and 48% IRR at spot US$1,900/oz gold price.

- Payback period of 4.7 years at US$1,600/oz gold price, reduced to 2.75 years at US$1,900/oz.

Large high-quality Mineral Resource and Ore Reserves:

- 1.35Moz Ore Reserve for a 10-year mine life based on Reserve ounces only.

- 12.5% increase in global Mineral Resource from 3.2Moz to 3.6Moz Au.

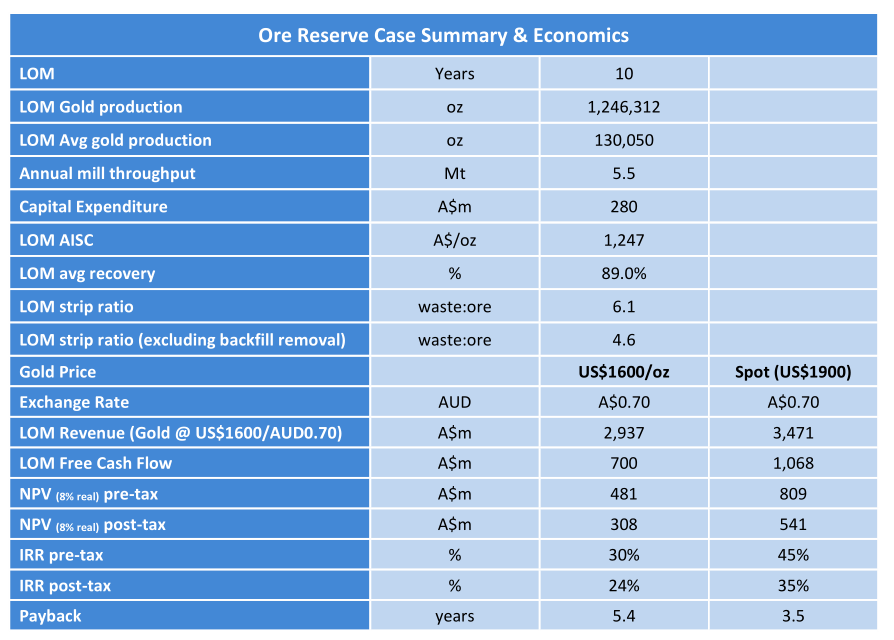

- Robust economics based on Reserve ounces only – pre-tax NPV8% of A$481m, 30% IRR and 5.4-year payback.

Significant upside to be unlocked as development studies advance:

- Significant project upside to be delivered through drilling campaigns currently underway to identify additional near-surface ounces for early years of ore production.

- Work programs now being planned for next phase of studies. If you’ve been following Kingston Resources (ASX: KSN) over the last few months, you might have been awaiting the PFS results from Misima prior to investing. The wait is now over with today’s announcement reporting the completion of a positive Pre-Feasibility Study (PFS) for its flagship 100%-owned Misima Gold Project. The PFS confirms the potential to develop a technically robust, large-scale, long-life, low-cost operation delivering gold production of 130,000oz per annum at forecast life-of-mine (LOM) all-in sustaining costs (AISC) of A$1,159/oz over a forecast 17-year mine life. The PFS is based on the redevelopment of the former Misima gold mine, which was operated previously as a successful 5.5Mtpa Carbon-in-Leach (CIL) open pit operation by Placer Pacific, producing 230kozpa over a 15-year production history.

What’s next on the roadmap?

Kingston is planning a new 5.5Mtpa CIL treatment facility and modern infrastructure on the footprint of the historic mine, establishing a new standalone, long- life gold mining and processing operation underpinned by two major ore sources – a cut-back of the existing Umuna open pit and an expansion of the existing small pit at Ewatinona in the Quartz Mountain area.

Conclusion

Together with the PFS, Kingston reported a maiden JORC Probable Ore Reserve of 48.3Mt @ 0.9g/t for 1.35Moz, which underpins the large scale, long-life Misima Gold Project, together with a further 12.5% increase in the global Resource to 144Mt at 0.78g/t for 3.6Moz.

Full Announcement and Deck

There's substantially more information in the full announcement so make sure you check it out along with the latest presentation:

Results

(source: Annoucement)