There's lots to cover in the latest XTEK update, with a brand new investor presentation released and linked below.

The presentation provides a great overview of the current business and covers the year in review.

Topics of note included:

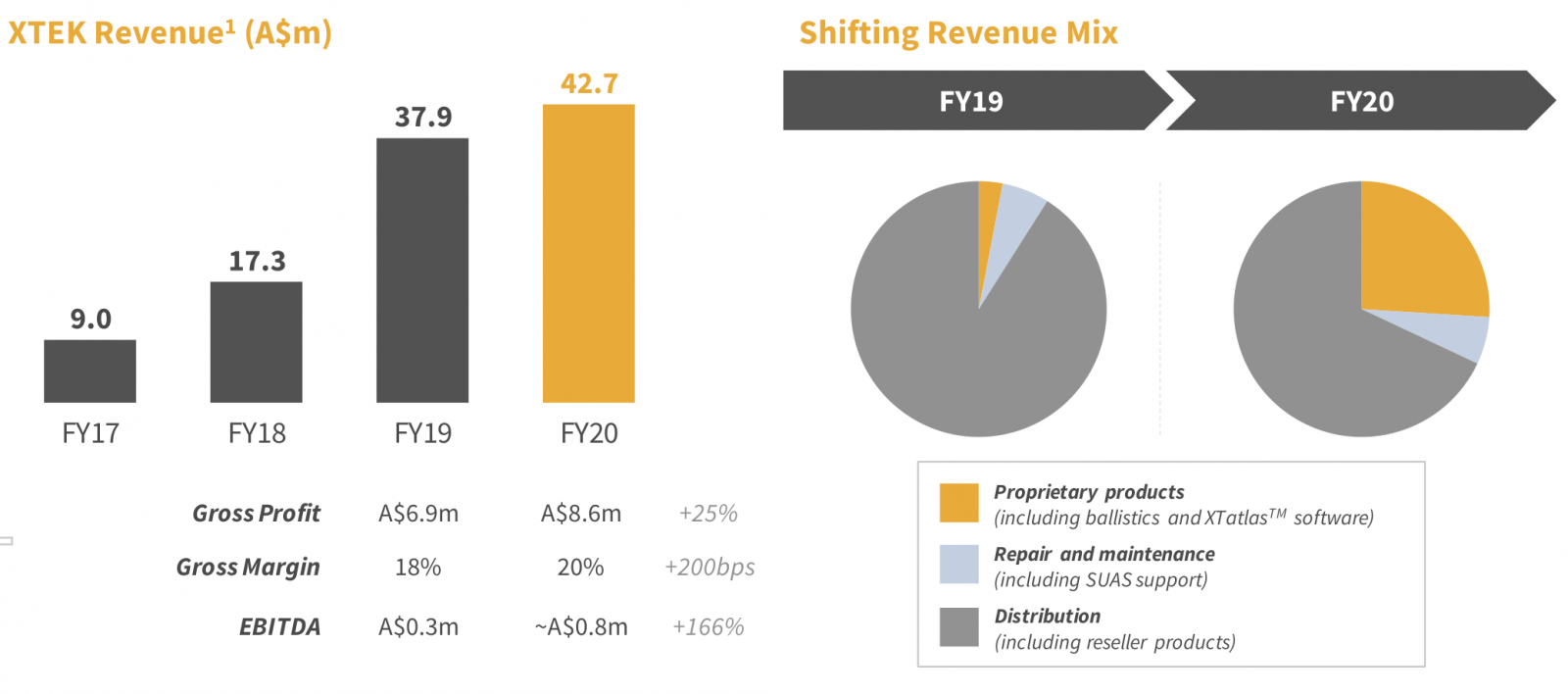

Record FY20 Revenue

XTEK achieved record FY20 revenue, underpinned by HighCom contribution in the US, and a shift to higher margin proprietary products. The foundational revenue from ongoing SUAS supply and support also remained solid.

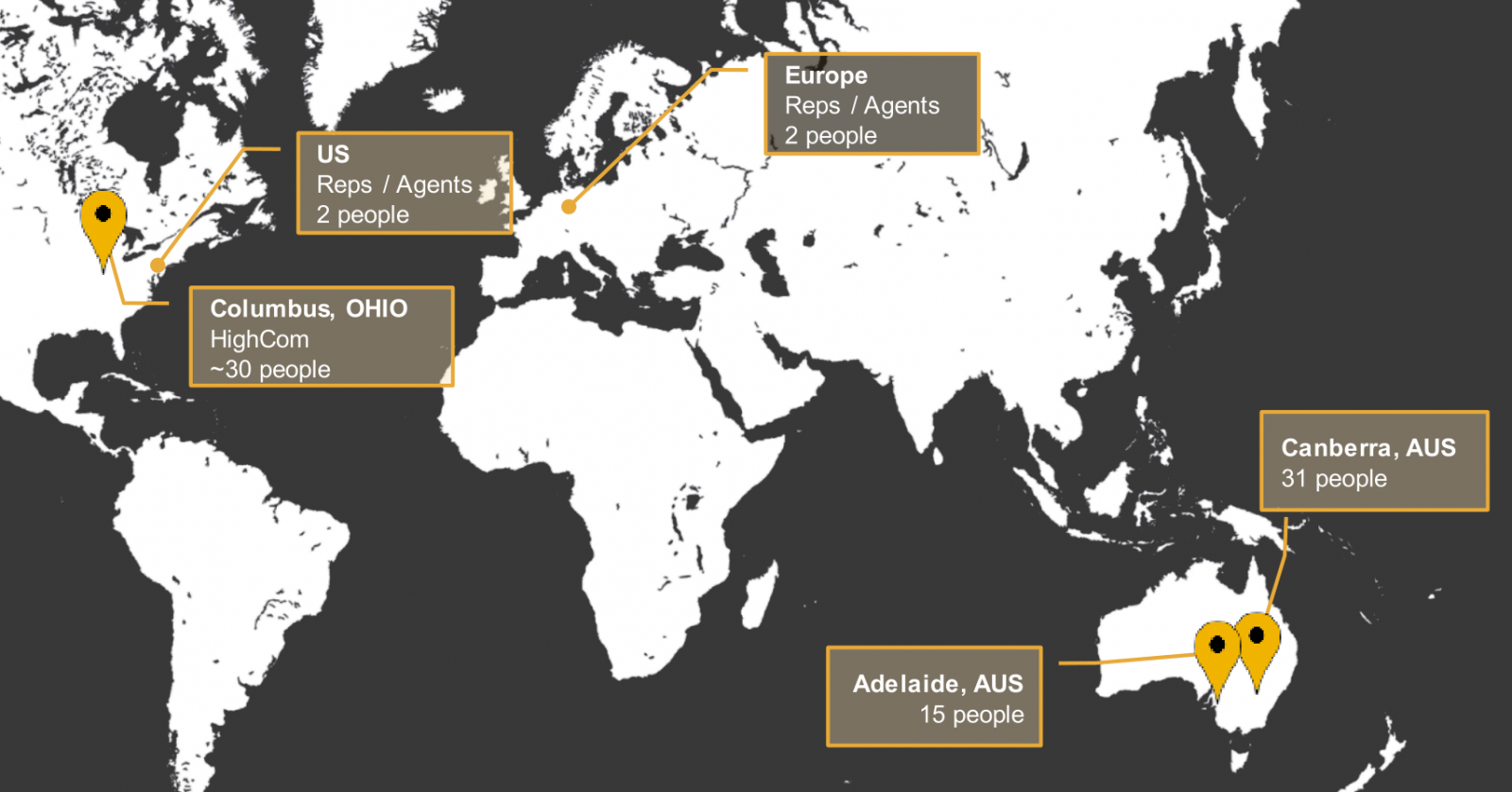

Expanded Global Network

With the acquisition of HighCom, XTEK's staff footprint in the United States has increased dramatically.

ISO9001:2015 Quality Assurance

In August, XTEK passed the ISO9001:2015 QA standard for the engineering and manufacturing in Adelaide and reduced defect rates by more than 30%.

Ramping Up Production

With optimisation of processes, and new ERP for production, XTEK has achieved significant internal cost reductions and risks.

Ballistics Product Range

Many investors already following XTEK will be familiar with the product range, but it was great to see the new mix inc HighCom range.

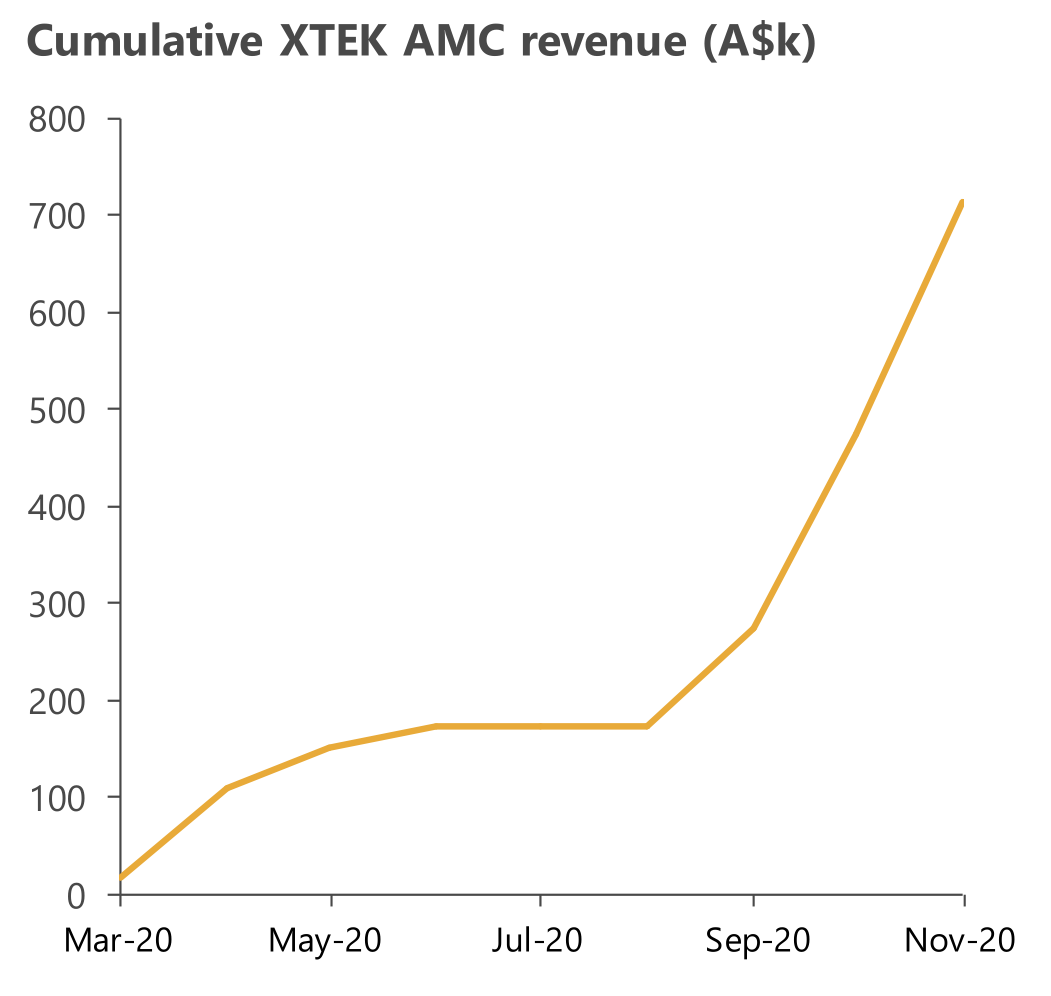

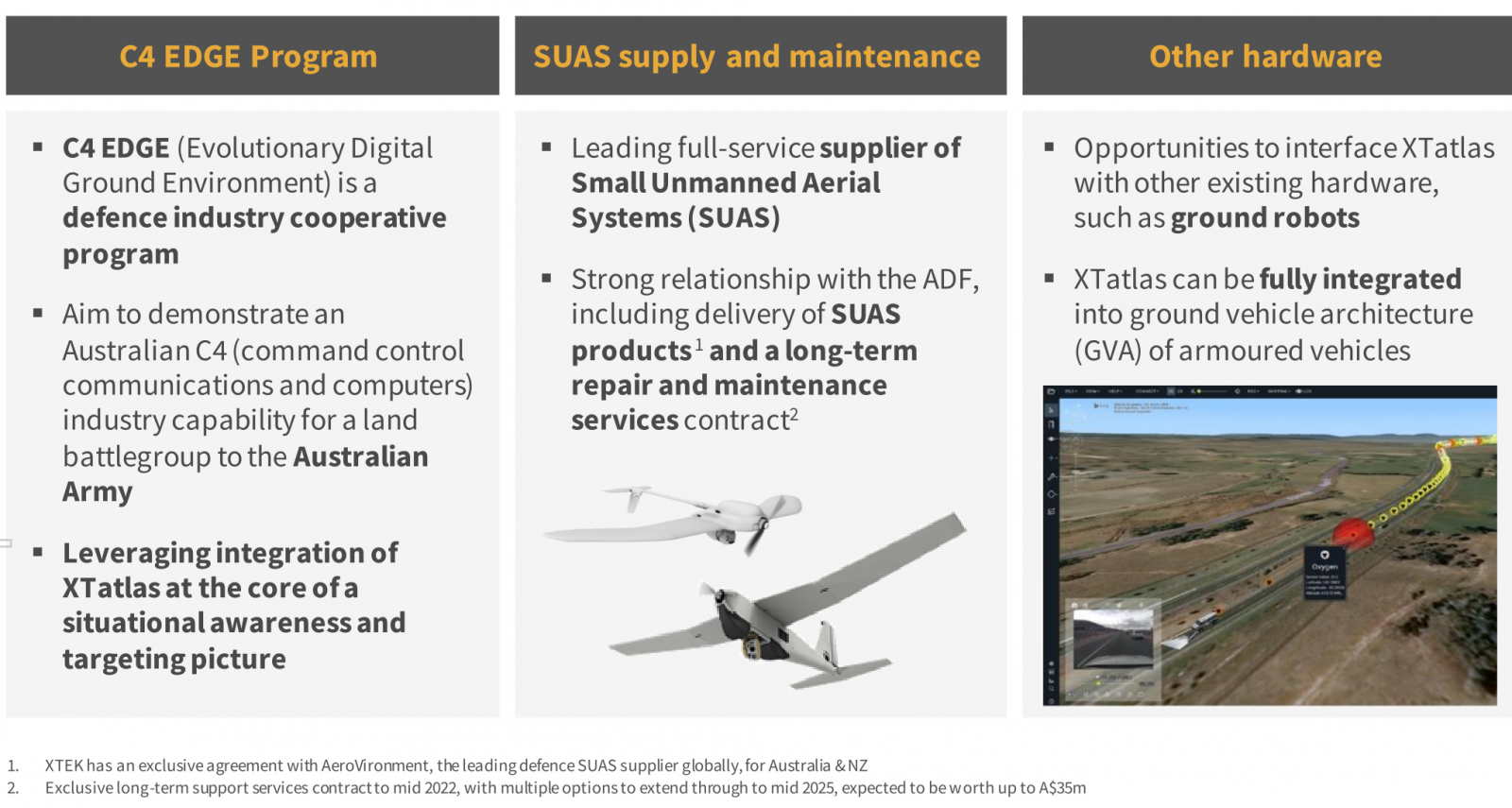

Battlefield Intelligence Product Range

Outlook

Targeting opportunities to underpin future revenue

- ‘Recurring’ US ballistic sales of ~A$14m p.a. (based on HighCom network).

- Finnish defence ballistic order of ~A$2m (with potential for further orders).

- SUAS support and maintenance contract worth ~A$5m p.a. (expected to increase as SUAS fleet grows).

- SUAS supply and spare parts to the ADF worth ~A$10m.

- A$70m+ of near-term opportunities across ballistic, SUAS and other solutions.

- Expect up to ~A$25m of other opportunities to formally arise during FY21.

Drivers of medium / long term order book

- Establishment of US based XTclave manufacturing capability will enable tendering for large US defence contracts that require locally made product.

- Increased focus on new product development – pipeline of new products to further drive growth.

- Increased sales and marketing resources deployed in the US and EU to handle anticipated growth in demand.

Strong Financial Outlook

XTEK reported a strong and exciting target revenue of A$100m revenue with future margins expected to increase to ~30%. This is underpinned by a shift to proprietary products that have higher margins than existing revenue mix.

Key Catalysts (12m and beyond)

- Appoint additional global defence / law enforcement sales resources (4Q CY20), including a strategic adviser to the Board.

- Delivery of ~A$2m of ballistic plates to Finnish Defence

- First tranche complete (one third of total contract)

- Delivery of final tranche (Q1 CY21)

- Launch additional ballistic products in the US, with near-term exports of XTclave products (CY20-CY21).

- Order key parts for US XTclave machine (CY21).

- Installation, commissioning and optimisation of US XTclave machine (CY22).

- Completion of space project in partnership with Skykraft and international parties (2H CY21).

- Achieve further commercial orders for XTclave products across domestic and international target parties.

- Supply of SUAS supply and maintenance and other reseller products to ADF.

Summary

XTEK appears well positioned for growth, underpinned by accelerated commercialisation of high value proprietary solutions and favourable market sentiment within the domestic and global defence industry.

If you want to talk more about XTEK, book in a time to contact us here https://www.smallcapinsider.com.au/contact

*Note: All information in this article should be read in combination with the full presentation linked below. *