What has happened?

In Kingston’s latest Quarterly Activities Report they announced that they were positioned for growth and success in 2021 after delivering a robust Pre-Feasibility Study (PFS) on the 3.6Moz Gold Project, raising $13 Million in capital and appointing Australian mining executive Mick Wilkes as non-executive Chairman.

What are the key highlights?

Misima Gold Project (Papua New Guinea)

In the December quarter, Kingston released the results of the Misima PFS which showcased an attractive gold development with potentially strong economic fundamentals. The key components of the PFS were:

- PFS confirming the potential for a long-life, low-cost gold mine with 1.35Moz maiden Reserve.

- The PFS also highlighted the possibility of a significant, long-life Asia-Pacific gold operation with a 130,000ozpa average annual gold production over a 17-year mine life. Additionally, there was also the potential of a 5.5Mtpa mining and processing operation on a brownfields site with an extensive mining history, along with a Conventional CIL plant fed by the main Umuna Open Pit and Ewatinona Starter Pit. These projects would have a low capital intensity with A$283m CAPEX including A$37m contingency.

- The PFS also revealed some potentially strong project economics with a Life-of-mine (LOM) average AISC of A$1,159/oz, LOM revenue of A$4.9 billion and LOM free-cash-flow of A$1.5 billion.

- The PFS also established 1.35Moz Ore Reserve for a 10-year mine life based on Reserve ounces only and a 12.5% increase in global Mineral Resource from 3.2Moz to 3.6Moz Au. Robust economics based on Reserve ounces only, pre-tax NPV8% of A$481m, 30% IRR and 5.4- year payback.

- Drilling programs also currently underway to identify additional near-surface ounces for early years of ore production.

Other Related Highlights:

- During the PFS, the Maiden JORC Ore Reserve was released in the December Quarter. The maiden JORC Probable Ore Reserve of 48.3Mt @ 0.9g/t for 1.35Moz underpins a large scale, long-life gold project at Misima, together with a further 12.5% increase in the global Resource to 144Mt at 0.78g/t for 3.6Moz. The Ore Reserve is based on a standalone mine plan and financial model excluding Inferred Resources.

- Another PNG highlight was the resuming of Drilling at the Misima Gold Project along with the commencement of the Environmental Inception Report (EIR) for the Misima Gold Project which was submitted to PNG’s Conservation and Environment Protection Authority (CEPA), marking the formal commencement of the environmental approvals process.

- Cooktown Stockpile verification project commenced to assist in bolstering confidence in existing early production ounces.

- A COVID Management plan was also established on Misima Island which included safety and hygiene education for staff members and the community along with daily temperature checks.

Livingstone Gold Project, WA

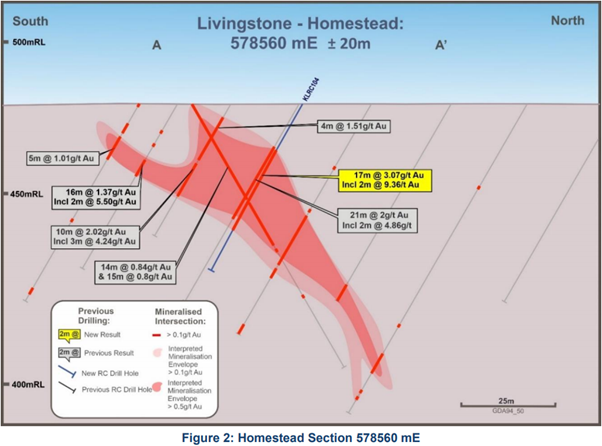

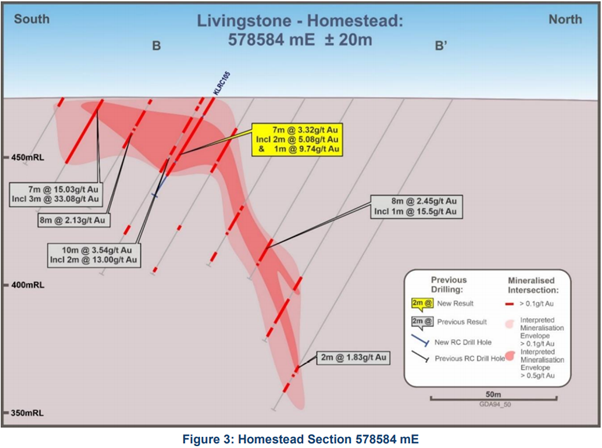

- RC Drilling at the Homestead Project delivered high-grade gold intercepts during the December quarter as a result of the drilling of five RC holes for 513m. Drilling successfully expanded on and confirmed historical results from drilling conducted by Western Mining Corporation, Sons of Gwalia and Talisman Mining.

- The drilling was undertaken within the existing JORC 2004 Inferred Resource* envelope (990,000t @ 1.6g/t Au for 50,000oz), and delivered best intercepts including:

- KLRC104 17m @ 3.07g/t Au from 14m

- KLRC105 7m @ 3.32g/t Au from 27m

- KLRC107 11m @ 1.00g/t Au from 104m

- KLRC108 11m @ 1.18g/t Au from 31m

- The campaign was successful in improving the confidence in the historical drilling with all holes returning high-grade intercepts of similar grade and widths.

Corporate Updates

- Following the successful release of the PFS and Maiden Ore Reserve, Kingston completed a $13 million capital raising in December. An institutional share placement was made at $0.26 per share to raise $12.5 million, with Mick Wilkes intending to subscribe for the remaining $500,000 worth of shares, subject to shareholder approval, for total equity raising proceeds of $13.0m.

- Following the completion of the economically robust PFS and maiden Ore Reserve for the Misima Gold Project, Kingston appointed Mick Wilkes as the non-executive Chairman.

- The Company ended the quarter with a cash balance of $16.6 million. Total exploration expenditure for the quarter was $1.8 million. During the quarter the Company made payments totalling $152,000 to associates or related parties reflecting fees, wages, and superannuation paid to Directors.