After successfully raising $6.4m from a recent institutional funding round, Walkabout Resources is on the cusp of developing the second-highest margin graphite mine in the world. Their flagship project in focus is the 100% owned Lindi Jumbo Graphite mine, which showcases a pre-tax NPV of US$355m and an IRR of 142%. Given the above metrics, one could argue that Walkabout Resources could possibly make a compelling investment case at their current market cap of only A$70.50m (As at 04/06/2021).

Lindi Jumbo Graphite Project Investment Highlights:

- Pre-Tax NPV10 of US$335m, IRR 142%, Payback Period of less than 24 months and low upfront capex of US$27.8m - LOM of 24 years producing 40kt of four discrete graphite in concentrate products.

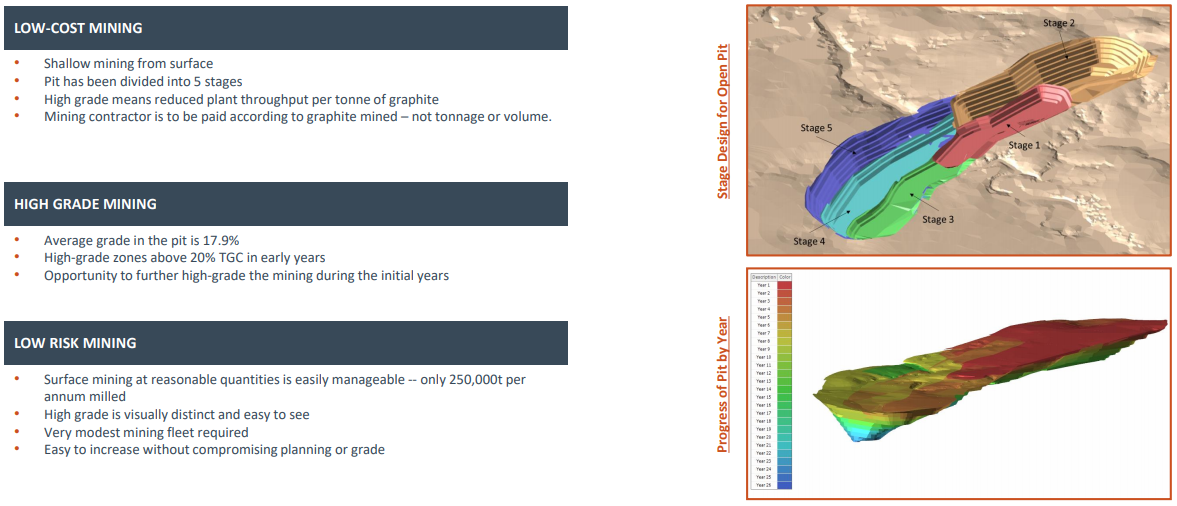

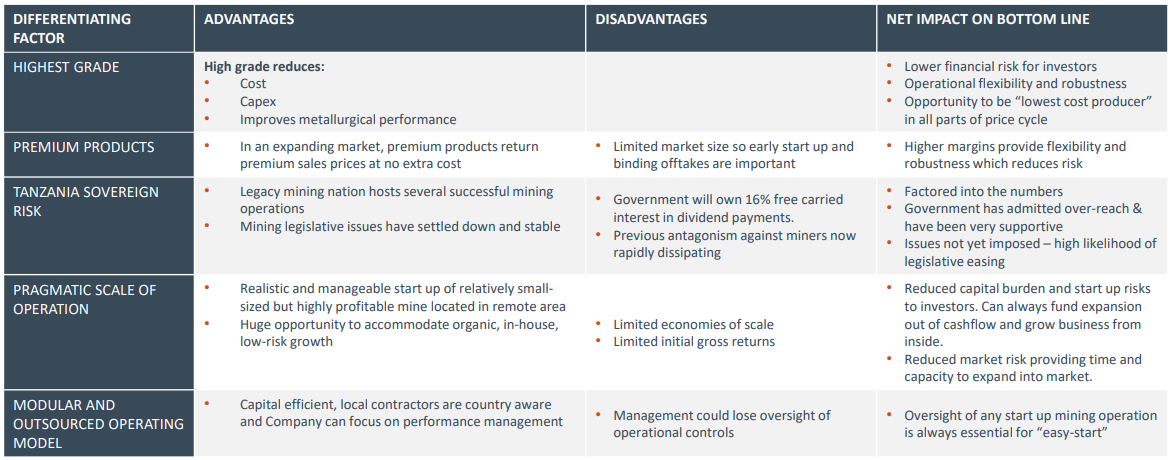

- Highest grade graphite reserve of any undeveloped graphite project in Africa provides a significant competitive advantage through low capital and operating costs (US$347/t) and facilitates highly favourable metallurgical characteristics.

- The modest production target to produce 40,000 tonnes of graphite concentrate above 95% TGC per annum for a life-of-mine of 24 years lends itself to an open cast mine with a small footprint using a very small mining fleet.

- Binding Offtakes in place for 75% of planned annual production as well as non-binding offtakes for the remainder..

- High basket price of graphite concentrate US1,515/t due to superior large flake distribution.

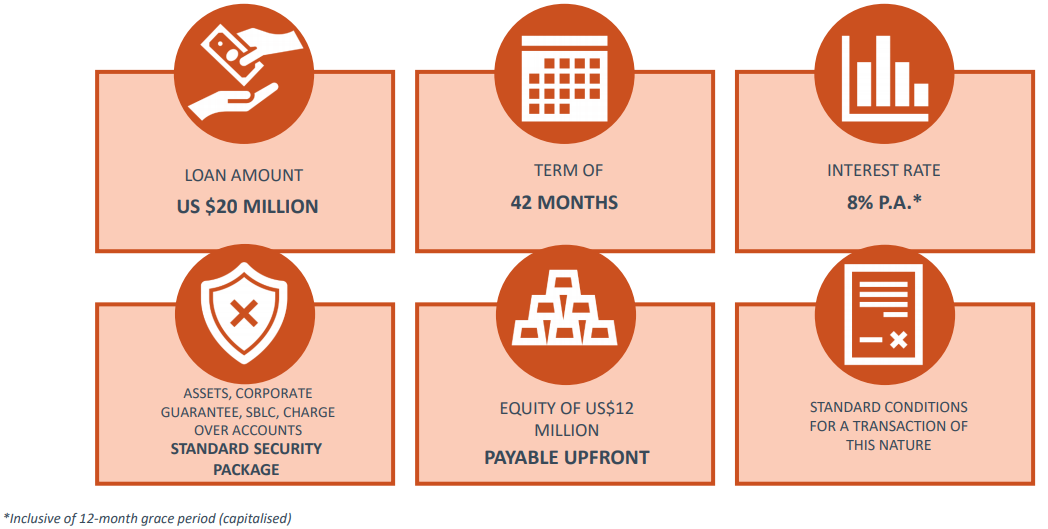

The CRDB Bank Mine Development Loan:

The company itself is at an inflexion point after securing a US$20m (A$25.8m) debt facility from the CRDB Bank of Tanzania, pending an equity contribution of US$12m. Walkabout Resources is looking to raise the US$12m in separate tranches, the first tranche being the institutional capital raise which secured $6.4m, with a second funding round taking the form of a $7.6m rights issue for retail investors. At current, $3.63m of the issue is being underwritten by a Director and various shareholders, further illustrating the confidence current stakeholders have in the project's credibility.

Some of the Main Risks:

Please see the main Walkabout page for more information on this unique opportunity.