What has happened?

Today SciDev (ASX:SDV) announced their quarterly activities report for the period ending 31 March 2021. The report highlighted a +195% increase in cash receipts vs PCP, along with coverage of their recently acquired exposure to PFAS through the acquisition of Haldon Industries. The Company also reported net cash from operating activities for the period of A$1.46m.

What are the key highlights?

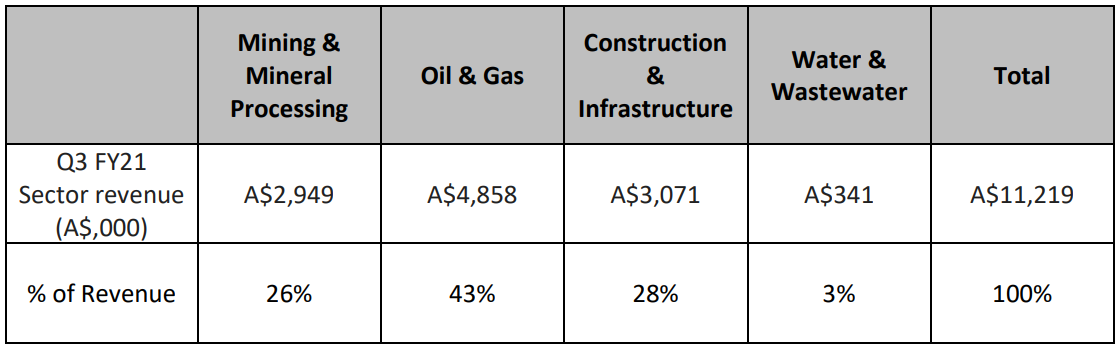

- SciDev announced a record quarterly cash receipt of A$11.3m and sales revenue of A$11.2m for Q3 FY21. These results are significant as the cash receipts have jumped +194% PCP.

- The Company also reported a net cash flow from operations of A$1.5m, with an overall cash balance at the end of the period of A$8.1m.

- SciDev noted that the quarter's gross profit margin was on target and in line with previous quarters at ~23%.

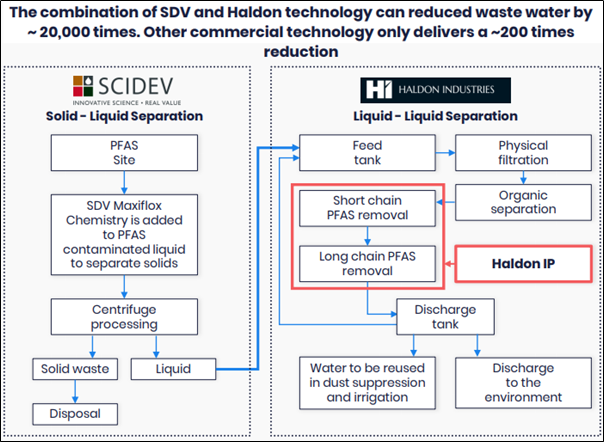

- During the quarter, SciDev acquired Haldon Industries, which allows the Company to potentially achieve strategic growth in the water and (PFAS) polyfluoroalkyl substances sector.

- SciDev also announced some big deals in the quarter with the signing of the MaxiFlox® supply agreement with Eramet subsidiary SLN in new Caledonian Nickel.

- Furthermore, during the quarter, the Company announced that it would be doing MaxiFlox® field qualifications at Fortescue Metal Group's Solomon Hub.

- The report also highlighted the Company's solid business development pipeline, along with ongoing field qualifications in several sectors.