We believe Veris is a potential long-term opportunity for investors which has arisen due to short-term concerns about its surveying division’s margins. It is our view that this is a distraction from the longer-term potential that the company has which is to become a national leader in a diversified array of services including town planning, high margin geospatial services, communications and other professional services.

In addition, unlike many companies in this market capitalisation range, Veris has the benefit of already having a significant revenue base, which was ~A$120m p.a. as per the last financial year. Because of this relatively large revenue base, even an incremental improvement in existing margins in surveying could produce a material improvement in the group’s total EBITDA.

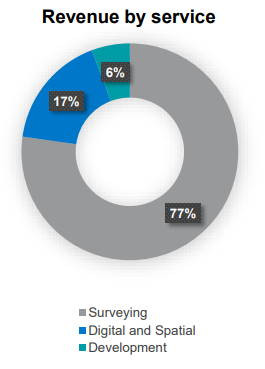

Further to this, we believe that the new Veris Group is more diversified than it was historically as a result of the Elton Consulting acquisition. The continued growth in higher-margin business segments and activities such as geospatial could also help increase margins for the Veris group over time. Diversification of revenue streams will also provide Veris with earnings resilience in the face of any downturn in any sector or region.

Key risks include, but are not limited to, the company's debt facilities which mature in November 2020 and the relatively low barriers to entry in surveying which may continue to pressure margins.

The information within this section has been provided by

Mawson Graham

and is for general information purposes only and is not intended to reflect any recommendations or financial advice.

The information in this section has been prepared without taking into account your objectives, financial situation or needs.

For this reason, you should consider the appropriateness of the advice or recommendation in light of your own personal circumstances, relevant risk factors,

the nature and extent of your risk of loss, as well as the legal and accounting consequences before acting making an investment or trading decision regarding

any Financial Product mentioned herein.

While it is believed that all information sourced and contained within this section to be accurate at the time of publication,

liability for any errors, omissions, accuracy or completeness of the information (except any statutory liability which cannot be excluded) is specifically excluded

by Mawson Graham, its associates, officers, directors, employees and agents.

Past performance is not a reliable indicator of future performance.

Important Disclosure: Mawson Graham, its directors, associates and employees advise that they may hold securities, may have an interest in

and/or earn brokerage, investor relations fees, corporate fees, and other benefits or advantages, either directly or indirectly from client transactions arising from

any information mentioned within this section and in documents published within this section.