Following the recent short squeeze of GameStop (GME) and AMC Entertainment Holdings (AMC) which saw share prices surge 1600% and 800% respectively, there are reports that a silver squeeze under the hashtag "#silversqueeze" could be next with the spot price of the precious metal surging, albeit temporarily as all "squeezes" are.

Outside of the hype, it did prompt us to have a fresh look at the commodity. The fundamentals of silver started to look particularly interesting around early 2020. The recent Biden administration's win saw them further bolstered with prices rising by almost 80% since its low in March last year, making it the best performing metal of 2020. Furthermore, silvers reputation as a safe-haven asset and its association with electrification/renewables may see the price rise even higher in the long term as demand increases for the metal.

###### Source: https://abcbullion.com.au/products-pricing/silver

Although the exact future price of silver remains uncertain, its status as a safe-haven asset and an alternative to gold provides a degree of price support as the aftermath of Covid-19 casts uncertainty on economic and financial market performance.

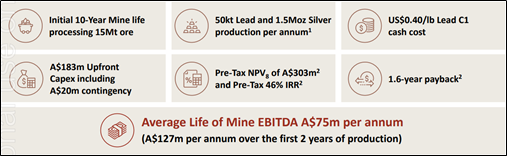

For investors looking for leveraged plays on silver; one company we've been working with and following for several months called Boab Minerals (ASX:BML), may be poised to gain if silver markets continue to see an increased level of interest. The company, formerly Pacifico Minerals, seems well-positioned to capitalise on the recent shift in commodity prices after announcing promising news from its Pre-Feasibility Study (PFS) of the Sorby Hills Lead-Zinc-Copper project which could stand to produce 1.5Moz of silver per annum based on life-of-mine averages. The PFS aided in highlighting the comparatively low-risk nature of the Sorby Hills Project with a large-scale mineral resource.

These developments have not gone unseen by investors with the share price rocketing by 575% since last year late April and jumping 19.78% (as at 01/02/2021) following today's market buying spree. The large jump in price was partly helped by a reverse stock split or stock consolidation in December of 2020.

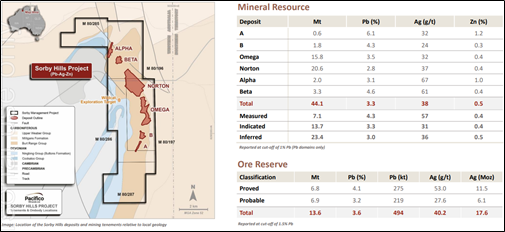

The reason why the PFS completed by Boab proves so vitally important is that it effectively confirmed that Sorby Hills is underpinned by a large near-surface Lead-Silver-Zinc deposit comprising of a Mineral Resource of 44.1Mt at 3.3% Lead, 38g/t of silver and 0.5% Zinc, and Proved and Probable Reserves of 13.6Mt at 3.6% Lead, and 40g/t of silver. BMY also launched the Phase IV drilling program to advance the Project towards Definitive Feasibility (DFS) status. The Phase IV drilling program was initially launched to highlight the significant upside potential of the Sorby Hills Mineral Resource. See below for the current mining resource and ore reserve figures.

The purpose of a DFS is to provide investors with a high degree of accuracy that the project is technically and financially robust.

As with any pre-production company, there are the usual risks that something unexpected comes up in the DFS, drilling program, or overall correlation with silver markets – however, these things generally tend to be "priced in" for small companies. Investors focused solely on short term investments should bear in mind that investing only on flash trends increases risk and uncertainty, therefore having a long term view on silver and the company is prudent.

However, for investors comfortable with the conclusions of their own independent research, Boab Minerals (ASX:BML) seems well exposed to the silver markets if the tailwinds continue.

If you've got any specific questions about BML and would like to talk with one of our analysts working on the company, feel free to send us an email at [email protected] or give us a call on 1300 131 551.

The information within this section has been provided by

Mawson Graham

and is for general information purposes only and is not intended to reflect any recommendations or financial advice.

The information in this section has been prepared without taking into account your objectives, financial situation or needs.

For this reason, you should consider the appropriateness of the advice or recommendation in light of your own personal circumstances, relevant risk factors,

the nature and extent of your risk of loss, as well as the legal and accounting consequences before acting making an investment or trading decision regarding

any Financial Product mentioned herein.

While it is believed that all information sourced and contained within this section to be accurate at the time of publication,

liability for any errors, omissions, accuracy or completeness of the information (except any statutory liability which cannot be excluded) is specifically excluded

by Mawson Graham, its associates, officers, directors, employees and agents.

Past performance is not a reliable indicator of future performance.

Important Disclosure: Mawson Graham, its directors, associates and employees advise that they may hold securities, may have an interest in

and/or earn brokerage, investor relations fees, corporate fees, and other benefits or advantages, either directly or indirectly from client transactions arising from

any information mentioned within this section and in documents published within this section.